The UK Government's Post-16 Education and Skills White Paper isn't just an update to Skills for Jobs (2021). It's a fundamental reset of how England's skills system operates.

This isn't about more funding or looser regulation. The government has made its economic priority explicit:

"We know that increasing skills is responsible for a third of productivity growth… Skills England reports that we will need 900,000 more skilled workers in our priority sectors to 2030."

The reforms represent a directional reset: fewer generalists, more specialists. Fewer subsidies, more partnerships. Less grant dependency, more commercial acumen.

For providers, the question isn't whether the reforms are good or bad. The question is: what position will you hold when the system stabilises?

At Bolt Search, we've translated the policy into strategic implications. We've looked at what matters most, where the opportunities lie, and what training providers should prioritise.

Less political analysis or news commentary. More strategic field guide for education leaders who need to move decisively.

Not everything in the White Paper carries equal weight. Here's what will genuinely reshape your operating environment:

A new central body coordinating national skills priorities, labour market data, and provider performance. The White Paper states that

"Skills England will provide the single authoritative voice on England's current and future skills needs… working in partnership with Strategic Authorities, employers and Employer Representative Bodies to identify skills gaps and ensure we have provision in place to fill them."

Translation: More joined-up planning, but also more scrutiny and performance transparency.

What changes: Your pitch must now align with national sector priorities and demonstrate data-driven decision-making. Skills England will be the arbiter of what counts as priority provision, and providers outside these priorities will find themselves at a funding disadvantage.

Sector-specific anchor institutions across construction, digital, clean energy, advanced manufacturing, and defense. According to the White Paper:

"Each Technical Excellence College will be a hub of excellence in a specific sector, with advanced facilities, expert staff, and strong employer partnerships… Colleges appointed as Technical Excellence Colleges will support other providers in their sector so that opportunities and benefits are spread across regions and learners."

Translation: Creates a two-tier market. Specialist anchors (funded) and delivery satellites (dependent on partnerships).

What changes: If you're not a TEC, you need a relationship with one. This hub-and-spoke model means geography and sector alignment now determine funding access. The phrase "support other providers" signals subcontractor relationships, not equal partnerships.

The Apprenticeship Levy scope expands to include modular short courses and upskilling. The government confirms:

"We want employers to be able to use the levy on short, flexible training courses starting from April 2026… designed to help employers respond quickly to evolving skills needs and invest in workforce development."

Translation: £3.5bn+ of employer funding becomes accessible to non-apprenticeship provision.

What changes: Providers who can offer "levy-ready" modular courses at Level 4-5 unlock new revenue streams. From April 2026, any provider with the right product can access employer levy budgets previously ring-fenced for apprenticeships. This is a genuine market expansion.

Adults get a 4-year loan entitlement for modular learning equivalent to 4 years of post-18 education. The White Paper describes this as:

"a significant transformation of the student finance system. We are introducing modular funding for the first time… making it possible to fund study on multiple courses and modules at once."

Translation: Adult education becomes more modular, self-directed, and competitive.

What changes: Your offer must be stackable, credit-bearing, and directly marketable to mid-career learners. This isn't incremental change. Modular funding fundamentally alters adult learner behaviour and creates competition from universities entering the short-course market.

Technology adoption isn't experimental, it's embedded as a quality marker. The White Paper specifies that:

"Skills England will harness artificial intelligence and data analytics to ensure that employment and skills support is responsive to changing economic demands… extracting insights from job postings, industry reports, and economic forecasts to anticipate future skills needs."

Translation: AI integration in teaching, curriculum design, and learner analytics are now table stakes.

What changes: Providers must evidence digital transformation, not just discuss it. If Skills England is using AI to predict skills needs, it expects providers to use AI to meet them. This covers curriculum development, learner support, and labour market responsiveness.

Consolidated regulation via OfS, Ofsted, and regional commissioners. Poor quality means defunding. The government states:

"We will simplify the regulatory framework to reduce bureaucracy for providers and facilitate closer integration between colleges and universities… while ensuring that high-value provision meets both individual and employer needs."

Translation: Outcomes, governance, and data transparency define market access.

What changes: Strong providers gain market share. Weak ones face merger or closure. "Simplify" here doesn't mean less scrutiny, it means clearer performance thresholds and faster consequences for underperformance. The focus on "high-value provision" signals that not all training is considered equally valuable.

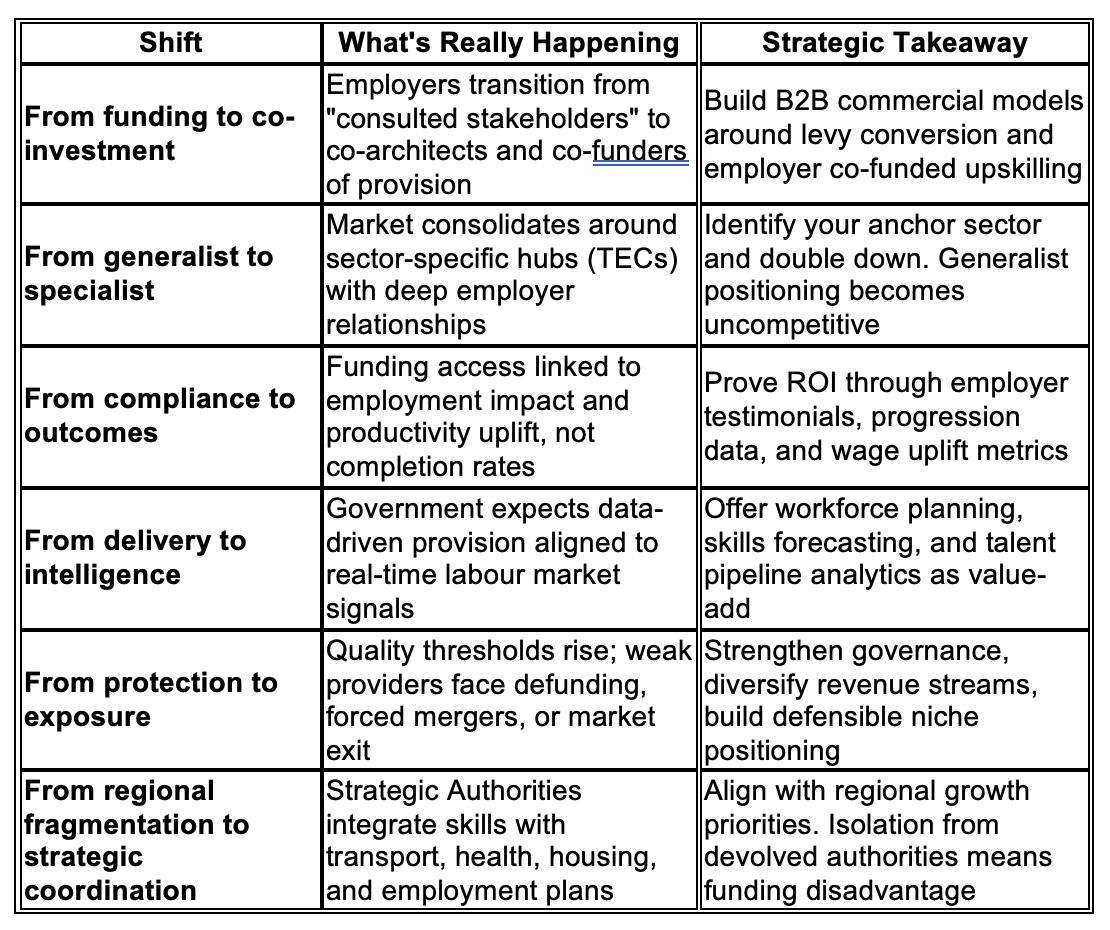

The reforms aren't just policy adjustments. They represent a fundamental change in how the skills system operates. Understanding this shift is more important than memorising the announcements.

The government makes its position explicit:

"We want a new relationship – a partnership – with employers that widens opportunities in the labour market and drives growth. Businesses must play their part and offer to co-invest in their workforce, both now and in the future."

The government is pulling control closer (centralised coordination via Skills England, TECs, Strategic Authorities) while pushing costs and responsibility outward (employer co-investment, performance-based funding, quality-based access).

This creates both opportunity (new funding streams, partnership models) and risk (increased competition, exposure for weak provision, dependency on partnerships).

Your strategic position depends on how quickly you adapt to this dual movement.

Strategic clarity begins with honest self-assessment. Here are a few questions to work through with your senior team:

These aren't rhetorical questions. Block out two hours with your SLT this month to work through them systematically. Your answers will reveal where you're vulnerable and where you can lead.

Objective: Establish strategic clarity and visible alignment with reform priorities

Critical Actions:

1. Conduct a TEC alignment audit

2. Strengthen your employer intelligence LINK HERE

3. Audit your modular readiness

4. Review data and governance infrastructure

Quick Win: Host a "Skills Reform Briefing" for your employer network. Position yourself as the expert translator of the reforms for your sector.

Objective: Develop distinctive capabilities that align with the new system logic

Strategic Builds:

1. Develop a Growth & Skills Levy portfolio

2. Launch AI-enabled delivery pilots

3. Formalise TEC or consortium partnerships

4. Build an employer co-investment model

The White Paper explicitly states:

"We will facilitate greater partnership between Technical Excellence Colleges and employers to co-finance capital investment in colleges… ensuring that large-scale projects are linked to FE colleges to deliver training in the places needed."

This opens a pathway for providers to:

5. Create skills intelligence services

Milestone Marker: Secure at least one formal partnership agreement (TEC, Strategic Authority, or major employer) that changes your revenue model.

Objective: Achieve sustainable competitive advantage and long-term strategic positioning

Transformation Initiatives:

1. Scale levy-funded provision

2. Establish regional infrastructure positioning

3. Build outcome-based contracting capability

4. Explore strategic consolidation

5. Develop platform-based scalability

Strategic Outcome: You've transitioned from a grant-dependent training provider to a commercially-viable skills infrastructure partner with diversified revenue, strategic partnerships, and defensible market position.

The reforms create space for different strategic archetypes. Both can succeed.

Trying to be both is dangerous. Being neither is fatal.

Characteristics:

Requirements:

Strategic Moves:

Characteristics:

Requirements:

Strategic Moves:

The Choice Point:

Ask yourself: "In three years, when someone asks what we're known for, what's the answer?"

If the answer is vague, or if it's "quality training in multiple areas," you're at risk.

The new system rewards clear, defensible positioning backed by evidence, relationships, and results.

These aren't hypothetical risks. They're visible patterns already emerging:

The Risk: "We'll wait and see how this plays out" sounds prudent but is actually a decision to become irrelevant.

Why It's Dangerous: Early movers secure TEC partnerships, employer relationships, and Strategic Authority alignment. By the time you're ready to act, the advantageous positions are filled.

The Risk: Relying primarily on devolved adult skills funding allocations.

Why It's Dangerous: Strategic Authorities will prioritise providers aligned with regional growth plans. If you're not in that conversation, budgets shift away from you.

The Risk: Assuming current quality standards are sufficient.

Why It's Dangerous: OfS and Ofsted are explicitly empowered to defund and restrict recruitment. The performance threshold is rising, and enforcement is real.

The Risk: Treating technology as optional or experimental.

Why It's Dangerous: AI adoption is an explicit expectation in the White Paper. Providers who can't demonstrate integration will be seen as outdated.

The Risk: Operating independently without TEC, Strategic Authority, or major employer partnerships.

Why It's Dangerous: The system is designed around collaboration and coordination. Isolation means funding disadvantage and limited growth options.

The Risk: Trying to be "good at everything" rather than "exceptional at something specific."

Why It's Dangerous: TECs are creating sector-specific centers of excellence. Generalists will struggle to compete on either cost or quality.

The White Paper makes the government's expectation clear:

"We want to move towards a collaborative, specialist system in which providers understand their role within the national and local skills agenda… This renewed sense of purpose and identity will help providers build relationships with employers."

None of these risks are fatal if addressed early. All of them are compounding if ignored.

The reforms don't wait for perfect information. Neither should you.

Three actions for this week:

1. Schedule a 2-hour strategy session with your SLT using the questions in this article as your framework. Get honest about where you're strong and where you're exposed.

2. Identify your top 3 target TECs or strategic partners and draft introduction emails. Don't wait for formal procurement processes, relationships form before opportunities are advertised.

3. Audit one flagship programme: Is it modular? LLE-eligible? Levy-fundable? If not, what would it take to get there?

The post-16 reforms aren't about more paperwork. They're about a different system logic. One that rewards data, partnerships, specialisation, and agility.

At Bolt, we work with providers navigating this transition, whether you're repositioning your offer, recruiting leadership talent for the new landscape, or exploring M&A opportunities.

The next 18 months will reward those who move early, partner intelligently, and build systems designed for the future, not the past.